Loans and mortgages are the common known terms in this era and people are getting them on daily basis. They get loan and mortgage to buy new vehicles and homes. The amount they get in that loan has to be paid to bank or loan firm in installments and it is not uncommon that sometimes, it’s not possible to pay the installment on time. If that situation is for a while and soon you will be able to pay the bank, you just write a sorry letter and explain your situation. But if something is wrong and you won’t be able to make that installment money for a long time or at least not full of it, you need to write a hardship letter to the bank. In this letter you describe your circumstances and request to lower the amount of installment you agreed to pay according to the contract. Actually the hardship letter is a second step you take in this process as once you have requested to lower the installment amount, the bank or the loan company asks you to provide some solid reasons for that and the hardship letter is the document that contains those reasons. This is an official letter and need to be written with care and consideration.

In this letter you explain the present situation of yours and the estimated duration of the time you won’t be able to pay the full installment amount. You should know that the bank or mortgage firm doesn’t want you out of your house as they have more benefits while you stay inside the house and pay the installments. So you have to consider the loan company as a common business firm who is getting profit from you and don’t want to stop that process. Once you have provided some solid and real reasons, they process your application and lower the installment amount. But you have to keep in mind that a lot of people apply for such a relief and you should present your situation in real and unique way to stand your application different among others.

Reasons such as you or your spouse has lost the job and now you are not making the money you were in the past so it’s not possible to pay the mortgage installment until you get a new job or you met an accident and admitted in hospital and the expenses are just too much that you won’t be able to save money for the installments. Reasons like your company decided to downsize and the only reason you didn’t lost your job is that you agreed to work on lesser salary or worst case scenario, your spouse has died and now you are a single parents and don’t getting any child support from the government. These are some reasons that convince the loan company to consider your application and don’t think of you as another person who just can’t pay the installment without any reason.

Guidelines to write a Hardship Letter:

- Start the letter by providing your basic information to the lender or Loan Company who lend you the money or mortgage. Information like you full name, you contact addresses and you account number in that firm or bank if you have any.

- In the first paragraph, explain briefly about your situation and the factors that led you to hardship. Whether you got fired from the job, got divorce or had to face a death in the family, state that clearly in the letter.

- In the second part, you mention the steps you have taken to overcome this hardship but there is nothing going right at this time.

- Attach the receipts for the previous installments and state that you are a responsible and law abiding citizen and never disappointed the company before but now you have serious problems and the company should consider your request for the hardship.

- Close the letter by stating that you hope the bank or loan company will soon process you request and give you some relief until you overcome your problems. Sign at the end and close the letter.

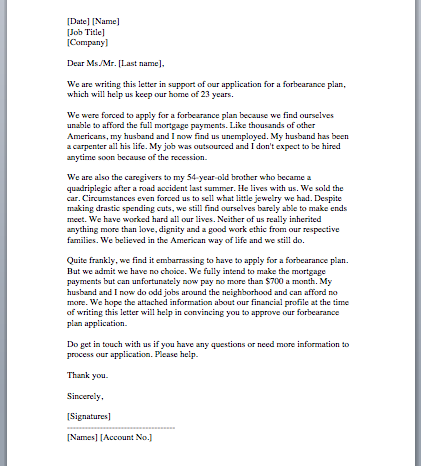

Hardship Letter Sample

Here is preview of this Free Sample Hardship Letter created using MS Word,

Here is download link for this Hardship Letter,